In the period 2012-2020, consumer credit has a growth rate of 33.7%, this rate is twice the growth rate of credit in the entire system.

This will reduce customers’ ability to access capital due to high interest rates (financial companies charge high interest rates to compensate for risks);

According to iHUB, there are two reasons leading to the above situation: Customers intentionally default on debt and fraudulent acts are increasingly sophisticated.

Credit institutions still lend to (deliberately fraudulent) customers because of a lack of data for appraisal, especially first-time borrowers.

iHUB’s solution will help: verify customers opening accounts and provide credit scores for first-time customers.

Customer verification software equipment has the following advantages:

– Vietnamese engineer team for research and production

– Ensure data safety and system security

– Meets technical standards of the Ministry of Public Security and the Ministry of Information and Communications

– Connect to C06 to authenticate real/fake citizen identification.

iHub’s citizen ID authentication device.

iHUB provides credit scores through the Alternative Credit Scoring model.

– Has a higher coverage rate than other effective models and focuses on disadvantaged groups in society, those without credit history

– Use rich data: personal identification information, taxes, insurance, telecommunications, traffic, legal…

– Apply graph data science to extract features as model input.

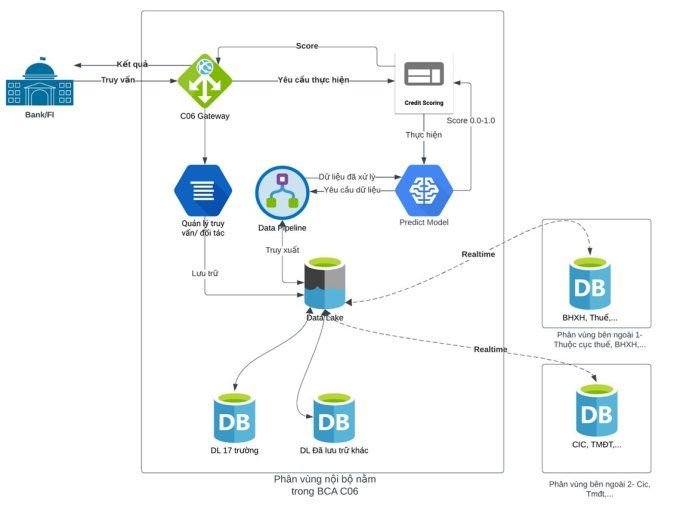

Scoring solution implementation process.